Hello everyone. Today, we will explain the basics of Options, a topic that can be intimidating.

What are options?

First of all, it should be mentioned that, like stocks, options are traded on an exchange. There is a seller and a buyer with different views who agree on a price. However, unlike shares, options are not issued by companies and they do not represent an ownership interest in a company. Options simply represent the ability or obligation to buy or sell the underlying security. Another difference with shares is that options have a finite life, meaning that there is a maturity date. Options are financial instruments that are part of the family of derivatives. Why is this called a derivative product? Because the option price is somehow derived from the price of the underlying stock. We will go over the important definitions in a few moments.

Two types of options

Call option

The holder (buyer) has the right to buy the underlying stock at the strike price if the stock price rises above the strike price before or at maturity. If the option holder exercises his right to buy the underlying stock, the writer (seller) has the obligation to sell them the stock.

Ex: The holder of a Royal Bank call option has the right to buy Royal Bank shares under certain conditions.

Put option

The holder (buyer) has the right to sell the underlying stock at the strike price if the stock price drops below the strike price before or at maturity. If the option holder exercises his right to sell the underlying stock, the writer (seller) has the obligation to buy the stock from them.

Ex: The holder of a Royal Bank put option has the right to sell Royal Bank shares under certain conditions.

Key definitions

Underlying

The underlying asset of an option can be a stock, a bond or an exchange rate on two currencies. In this video, we'll be focusing on the underlying stocks, because that's what we use in our strategy.

Strike price

The predetermined price at which the seller of the option will be obligated to buy or sell the underlying stock if the holder (the buyer) of the option exercises his right. In other words, it is the transaction price agreed upon by both parties.

Premium

Price paid for the option by the buyer and the price received by the seller. Supply and demand in the market determine the amount of the premium.

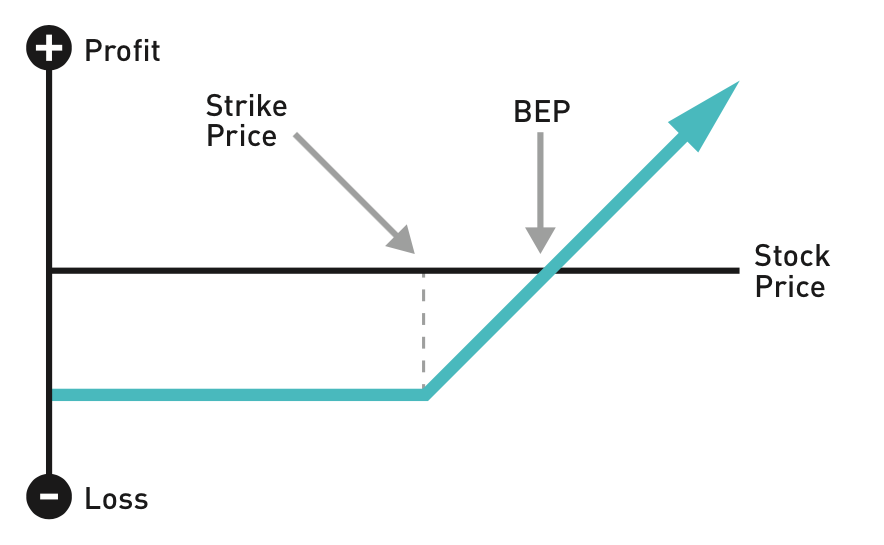

Breakeven point (BEP)

The stock price at which an option strategy results in neither a profit nor loss.

Expiration

Date on which the option expires.

Time decay or erosion

A term used to describe how the time value of an option can “decay” or reduce with the passage of time.

Contract

1 option contract = 100 shares

Exposure

This is the amount that is at stake, should the option be exercised. It is therefore the strike price multiplied by the number of contracts multiplied by 100.

At-the-money

A call option is said to be at-the-money when the price of the underlying stock is identical or relatively close to the option strike price.

In-the-money

If the option is “in-the-money”, this means that the price of the underlying stock has reached the strike price and that the holder of the option could choose to exercise his right to buy or sell.

- A call option is in-the-money if the strike price is less than the market price of the underlying stock.

- A put option is in-the-money if the strike price is greater than the market price of the underlying stock.

Out-of-the-money

If the option is “out-of-the-money”, then this means that the price of the underlying stock has not reached the strike price and that the holder is not able to exercise his right to buy or sell.

- A call option is out-of-the-money if the strike price is greater than the market price of the underlying stock.

- A put option is out-of-the-money if the strike price is less than the market price of the underlying stock.

Long

Being “long” means that you are the buyer (holder)

Short

Being “short” means that you are the seller (writer)

* Several definitions come from the Montreal Stock Exchange website

Montréal Exchange - Options Strategies Quick Guide

Main strategies

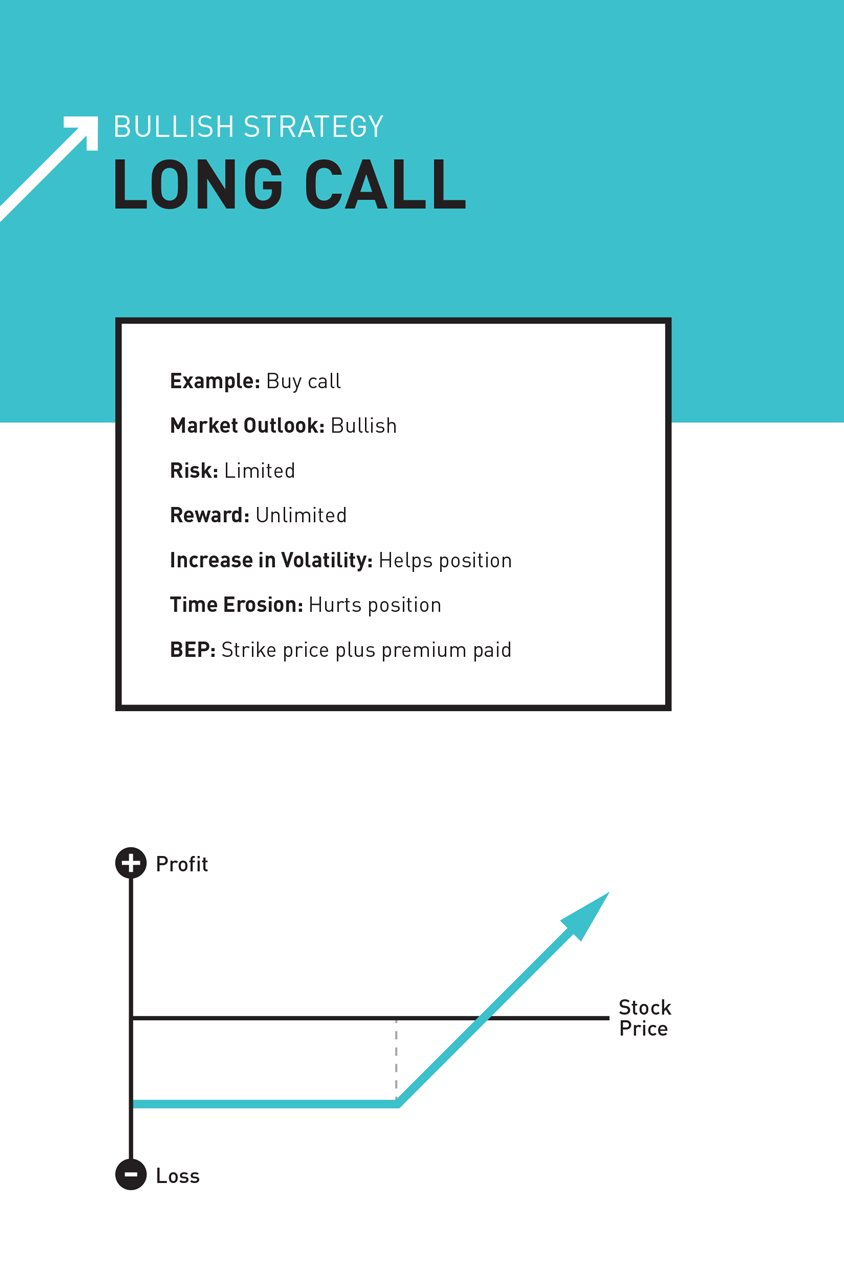

1. Long call (buying call options)

The buyer has a bullish view of the market. Typically, the buyer does not own the underlying stock and wishes to bet on the rise in the price of the stock. He pays a premium in the hope that the share price rises above the strike price during the period. If so, he will be able to buy the stock below the market price and profit from the rise in the value of the stock. If this is not the case, the loss will be limited to the premium paid.

In the graph, the premium paid represents the difference between the arrow and the horizontal axis. We can see that the call option becomes profitable when the arrow crosses the horizontal axis, which is at the breakeven point. So, for example, if the premium was $ 1 and the strike price was $ 15, the buyer of the call option begins to profit when the underlying stock rises above $ 16. If the stock does not reach the strike price upon expiration, the investor's loss is limited to the premium paid.

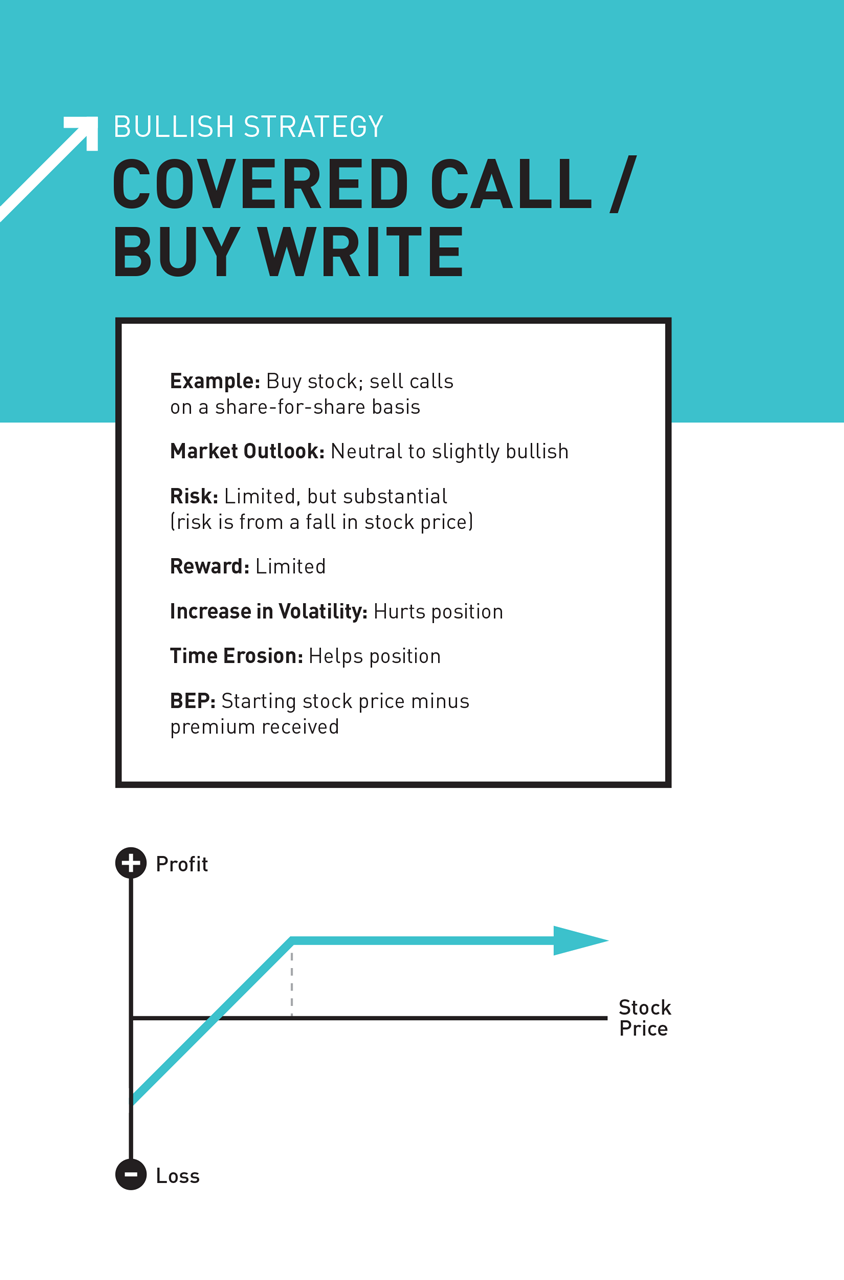

2. Covered call (selling/writing call options)

The seller usually has a neutral view of the market. The seller owns the underlying stock and wishes to generate additional income by sacrificing short-term upside potential. He therefore receives a premium and hopes that the share price remains stable and below the strike price during the period, otherwise he would be forced to sell the underlying stock at a price below the market price.

On the graph, the premium received represents the difference between the arrow and the horizontal axis. You can see that the profit is limited to the premium, because if the price of the underlying stock rises above the strike price, the option holder will exercise his right to buy and the seller will be forced to sell the stock at the strike price. On the other hand, since the seller of the option holds the underlying stock, he will lose if the stock price goes down since its value will be reduced.

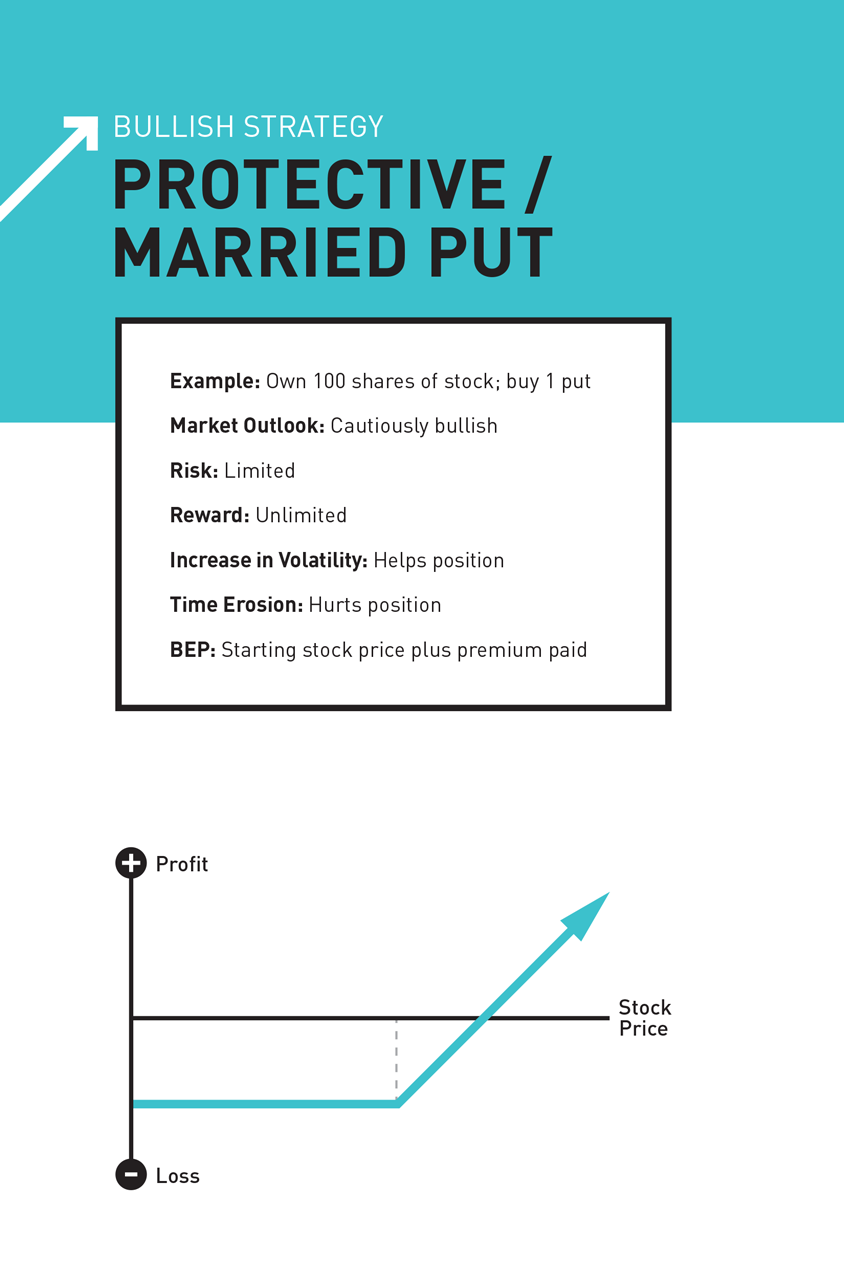

3. Protective put (buying put options)

The buyer typically owns the underlying stock and has a long-term bullish outlook but perceives a short-term downside risk. In order to protect against a potential decline, he is prepared to pay a premium in exchange for the right to sell his shares at the strike price if the share price drops below the strike price. The purchase of put options allows the investor to avoid crystallizing a capital gain if he were to decides to simply sell his shares. In addition, it limits the risk of “market timing”.

In the graph, the premium paid represents the difference between the arrow and the horizontal axis. If the price of the underlying stock rises, the investor has unlimited profit as he owns it. However, if the share price drops below the strike price, the option holder has a guarantee that the option writer will buy his share at the strike price. His loss is therefore limited to the premium paid.

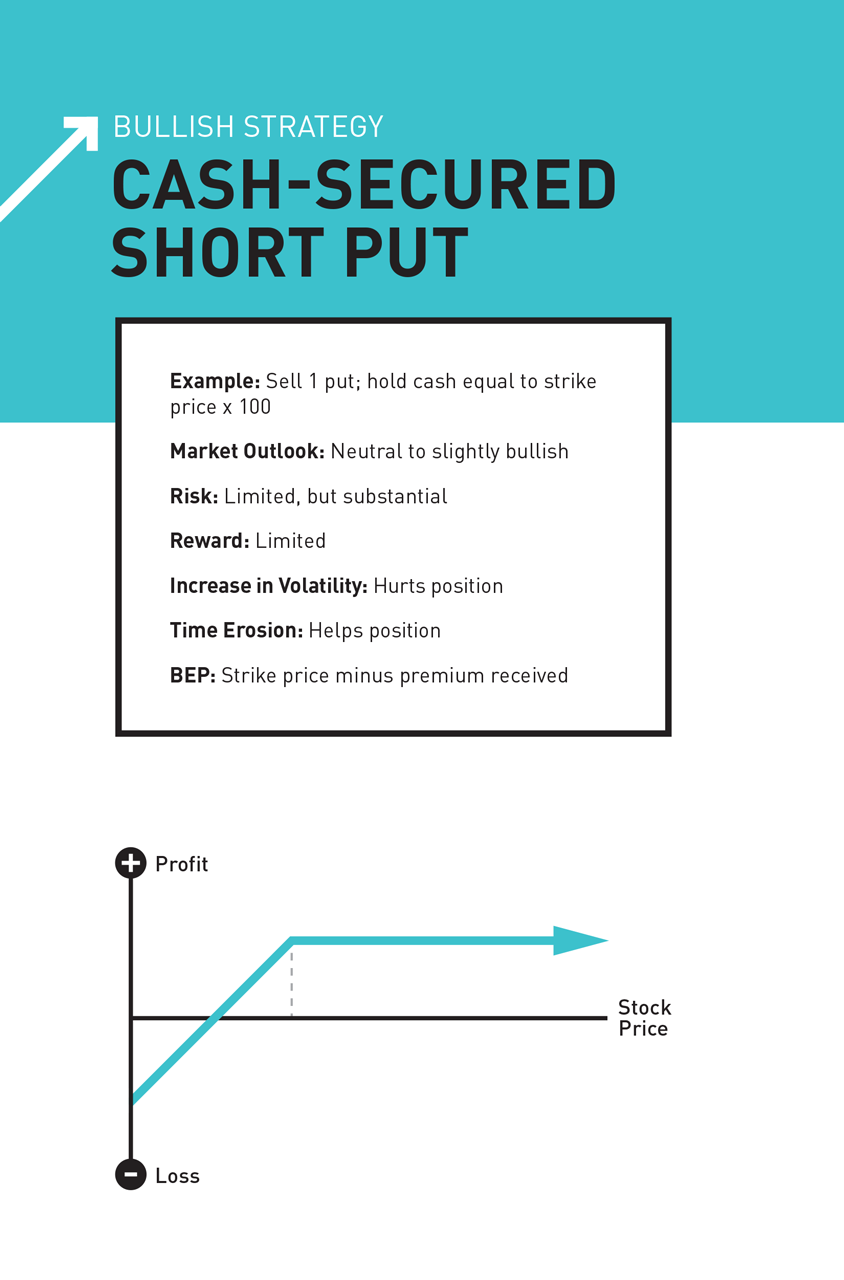

4. Cash-secured short put (selling/writing put options)

The seller has a neutral view of the market or only expects a slight rise in the near future. Typically, the seller is primarily interested in generating additional income but would be willing to purchase the underlying stock at a price lower than the current price if the stock price goes down.

On the graph, the premium is again represented by the difference between the arrow and the horizontal axis. We can see that the profit is limited to the premium received. If the price of the underlying stock declines below the strike price upon expiration, the seller of the option is obligated to buy the stock at the strike price and could suffer the subsequent drop, if any. It is possible that the purchase price (strike price) is higher than the market price.

So this is what completes our article on the basics of options trading. Thank you very much for reading and we hope you found it useful!

Disclaimer

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Marc-André Turcot, and not necessarily those of Raymond James Investment Counsel Ltd. Investors considering any investment strategy should consult with their investment advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision.